YVERDON-LES-BAINS, SWITZERLAND – 09 MAY 2023 : Ecorobotix, the Swiss manufacturer of ARA, an AI powered plant-by-plant recognition and ultra-high precision smart spraying system, announced the completion of a $52 million (CHF 46 million) funding round, jointly led by AQTON Private Equity GmbH and Cibus Capital LLP, with additional investments from Swisscanto Invest/Swisscanto Growth Fund I, Yara Growth Ventures, Flexstone Partners, and from existing investors including Swisscom Ventures, BASF Venture Capital, 4FOX Ventures, and Verve Ventures. The funding will accelerate Ecorobotix’s geographic expansion across new and existing markets and accelerate new product development.

Stefan Quandt, owner of AQTON PE (co-lead investor), explained his company’s decision to invest in Ecorobotix:

I’m looking forward to helping grow businesses like Ecorobotix which are having a positive impact on agriculture and the environment. Ultra-high precision agriculture and solutions like ARA from Ecorobotix are critical to improving farmer efficiency and helping move towards an eco-friendlier future.

Stefan Quandt, owner of AQTON PE

With customers in 15 European markets, these investments will further accelerate Ecorobotix’s rapidly growing business. Ecorobotix will use the new capital to expedite the growth of ARA worldwide, particularly in the Americas. The capital will also help reinforce the company’s mission to radically change agriculture for the better by offering smart, innovative, and sustainable crop treatment solutions. ARA saves farmers money and makes their lives easier, while simultaneously respecting the environment by massively reducing input costs about 70-95%, increasing crop yields, reducing the impact on soil, and preserving biodiversity.

We are proud to be working with investors who clearly see the environmental benefits of our ultra-high precision technology. With these new investments, we will deliver ARA to more farmers, in more markets, increasing agricultural productivity while protecting the environment and reducing CO2 impact.

Ecorobotix CEO, Simon Aspinall

For this financing Ecorobotix worked with UBS Growth Advisory and Oaklins France as advisors. The capital raise included $48.3M (CHF 43.1M) of new equity and $3.4M (CHF 3M) of new financing facilities thanks to the FOEN Swiss Technology Fund. The new capital will enable Ecorobotix to grow into new markets, expand the product range, and build on the existing commercial success of ARA in Europe.

Ecorobotix

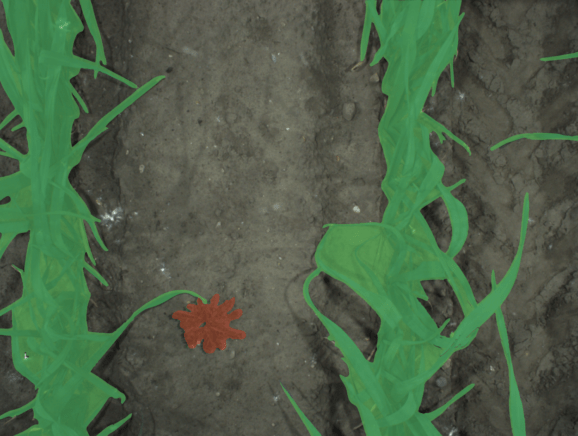

Ecorobotix is a Swiss company, Certified B Corporation®, founded to radically change agriculture for the better to respect the environment by reducing chemical/energy use and impact on soil. Ecorobotix developed ARA, a revolutionary plant-by-plant data solution and ultra-high precision crop treatment that reduces the use of herbicides, pesticides, growth treatments and liquid fertilizers by 70-95%, while increasing crop yields by 5% or more and significantly decreasing CO2 emissions. Using AI technology and its unique ultra-high precision spraying system, ARA can recognize individual plants, classify them in real-time, and spray the weeds with an unprecedented precision of 2.4x2.4in (6x6 cm) without affecting the surrounding crops or soil.

The following investors are listed in alphabetical order.

4FOX Ventures

4FOX Ventures is a leading healthcare and technology focused venture capital team managing investments in the most innovative and fast-growing companies in Switzerland. 4FOX Ventures invests in the sectors of technology, agriculture, big data, and artificial intelligence.

AQTON Private Equity GmbH

AQTON PE is a holding company wholly owned by the German entrepreneur Stefan Quandt and combines both venture and private equity investments.

BASF Venture Capital GmbH (BVC)

BASF creates chemistry for a sustainable future. BASF Venture Capital GmbH also contributes to this corporate purpose. Founded in 2001, BASF Venture Capital invests in Europe, United States, Canada, China, India, Brazil, and Israel with a goal to generate new growth potential for current and future business areas of BASF by investing in young companies and funds. BASF venture investments include decarbonization, circular economy, agtech, new materials, digitization, and new, disruptive business models.

Cibus Capital LLP

Cibus Capital LLP is the London-based investment advisor to the Cibus funds. The Cibus funds partner with food and agriculture companies that provide investors with a risk-adjusted return on capital and a sustainable competitive advantage. Cibus has raised over USD 1bn to invest in two strategies: mid-market growth/buyout investments in food production and processing businesses and late stage agrifood technology companies.

Flexstone Partners

Flexstone Partners invests, directly or through funds, in well-managed, ethically responsible companies sensitive to the ESG agenda, such as having a minimal impact on the environment and adhering to fair labor, human rights and sustainable business practices. Flexstone Partners is an affiliate of Natixis Investment Managers, one of the world’s largest asset managers.

Swisscanto Invest

Swisscanto Invest is the asset management arm of the Zürcher Kantonalbank group, one of Switzerland's largest fund providers, developing high-quality investment and pension solutions for private investors, companies, and institutions. The Swisscanto Growth Fund provides capital to companies in the expansion phase active in the information, communication, technology (ICT) as well as in the healthcare sectors, mainly in Switzerland and opportunistically abroad. The Swisscanto Growth Fund aims at creating added value during the market penetration by supporting its portfolio companies with capital, know-how and access to international partners for further expansion until a successful exit.

Swisscom Ventures

Swisscom Ventures is the venture capital arm of Swisscom AG, the leading telecom and IT provider in Switzerland. Swisscom Ventures invests both in Switzerland and internationally in early-stage digital companies that have the potential to become global tech winners.

About Verve Ventures

Verve Ventures is a network and technology driven venture firm who have invested in over 140 science and technology startups across Europe. Based in Zurich, Switzerland, Verve Ventures has an annual investment volume of more than EUR 60M and belongs to the top 10% most active startup investors in Europe.

Yara Growth Ventures

Yara Growth Ventures is the venture investment team within Yara International ASA investing in disruptive startups in the agri-food industry globally in order to advance the mission of responsibly feeding the world and protecting the planet.

For inquiries contact media@ecorobotix.com

PDF to download on our pressroom : ecorobotix.prowly.com/